Press Release

|July 11,2025Propnex's Consumer Survey Shows 7-In-10 Respondents Do Not Expect Home Prices To Fall In Next 12 Months; Easing Interest Rates Seen As Motivation To Buy A New Home By Half Of Those Polled

Share this article:

11 July 2025, Singapore - PropNex has today published the 2025 edition of its Homebuyer Sentiment and Preferences Report, which not only provides an update to its 2023 report but also dives deeper into the housing budget and financing options of prospective buyers, as well as the impact of shifting market trends on their purchasing decisions.

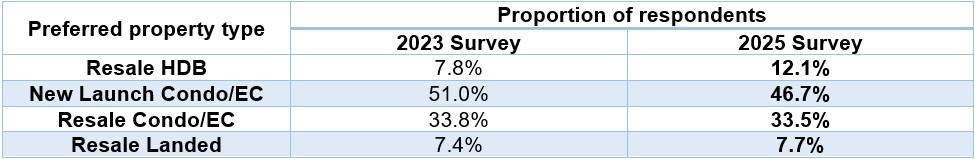

Findings from a survey of more than 1,100 respondents showed that while private housing aspirations remain strong, a slightly higher proportion of respondents have opted an HDB resale flat as their preferred housing type in this edition of the survey compared with that of 2023. Around 12% of those polled prefer HDB resale flats, higher than the 8% proportion in 2023 (see Table 1). That said, there is still robust interest in non-landed private homes, with 80% of the respondents favouring either a private condominium or executive condominium (EC) unit on the new launch or resale market.

Table 1: Preferred property types cited by respondents (2023 vs 2025)

Meanwhile, over 7-in-10 of the respondents said they do not expect the prices of private homes and resale HDB flats to fall in the next 12 months. This follows the multi-year price growth in both segments of the market where private residential property prices climbed for eight years straight (2017-2024), while that of HDB resale flats increased consecutively for six years from 2019 to 2024.

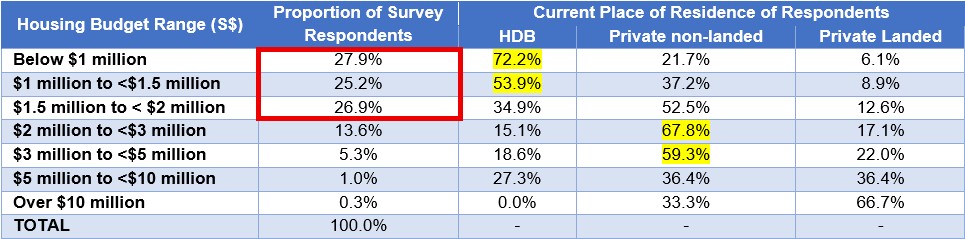

Ismail Gafoor, Executive Chairman and CEO of PropNex, said, "We expect private home prices and HDB resale flat prices to maintain their growth streak in 2025, but the pace of increase will likely be more modest at around 3% to 4% for private homes and 4% to 5% for HDB resale flats, as per our forecast for this year. It is good that prices are moving at a more sustainable pace because the housing budget of prospective buyers continues to be relatively tight. Our survey findings showed that buyers are price sensitive, with 80% of the respondents citing a home purchase budget of below $2.0 million (see Table 2), which may potentially limit their options, particularly in the new launch market. Incidentally, this is lower than the 82% proportion with a budget of under $2 million in the previous survey in 2023 - suggesting possible market adjustments to rising prices as some prospective buyers could have raised their housing budget slightly."

Findings indicate that HDB flat dwellers are more price conscious, with a substantial portion of them citing a budget at below $1.5 million. For instance, 72.2% of those with a budget of under $1 million reside in an HDB flat, while 53.9% of those with a budget of $1 million to below $1.5 million live in public housing.

Meanwhile, respondents who are living in private homes (non-landed or landed) accounted for a greater proportion of those who have a higher housing budget of above $2 million. In particular, those who reside in non-landed private homes made up 67.8% of respondents who cited a budget of $2 million to under $3 million, and 59.3% of those with a budget range of $3 million to below $5 million.

Table 2: Housing Budget of Survey Respondents

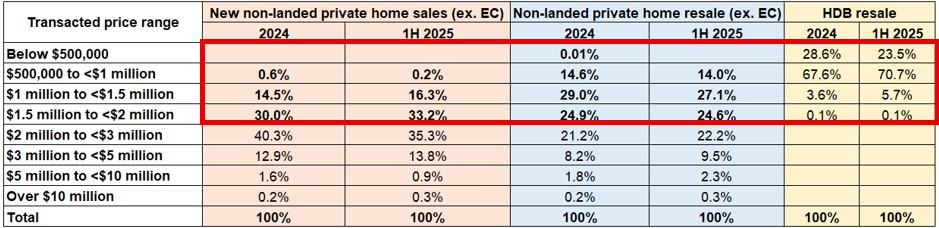

Table 3: Proportion of new and resale non-landed private homes (ex. EC) and HDB resale flats sold by transacted price range

Based on the transacted price range of non-landed private new homes sold in 1H 2025 (up till 29 June), nearly half of the new non-landed private homes (ex. EC) sold were priced at below $2 million - which would fit the budget of the majority of survey respondents. Meanwhile, the resale market opens up even more options - more than 65% of non-landed private homes were transacted for under $2 million in 2024 and 1H 2025, while all HDB resale flats sold were transacted at below $2 million (see Table 3).

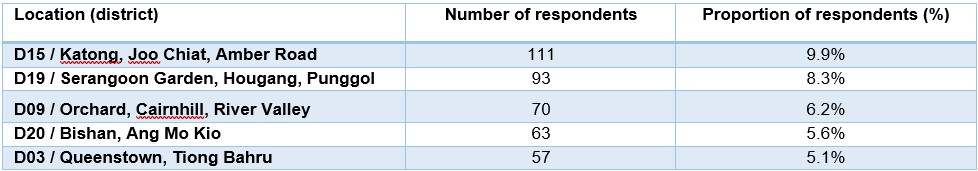

Wong Siew Ying, Head of Research and Content, said, "In view of the relatively tight housing budget among most of the respondents and a preference for private homes, it does appear that perhaps there may be a need for some respondents to either review their housing budget, or strike a compromise between cost and unit size and/or choice of location. Among respondents who cited a preferred location, District 15 (Katong, Joo Chiat, Amber Road) emerged as the most popular area, as selected by 10 per cent of the respondents (see Table 4). This is followed by District 19 (Serangoon Garden, Hougang, Punggol) and District 9 (Orchard, Cairnhill, River Valley)."

Table 4: Top 5 most preferred locations amongst respondents

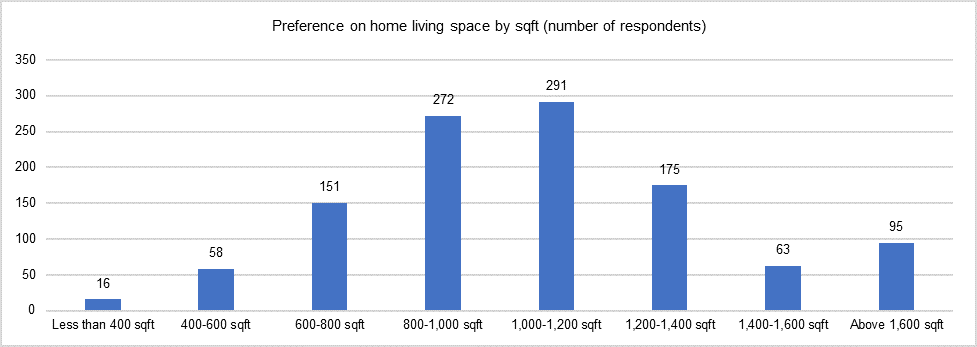

Chart 1: Preferred unit size among respondents

Meanwhile, the most preferred unit size range was 1,000 to 1,200 sq ft, as selected by 291 respondents (or 26%), followed by unit size spanning 800 to 1,000 sq ft which was the choice of 272 respondents (or 24%). This is perhaps not unexpected since more than a quarter of those polled find their current home too small. Also unsurprisingly, the most important attribute sought by respondents when they purchase a new home is proximity to the MRT station/ bus interchange/ transport hub, as picked by about 44% of those surveyed.

Mr Gafoor added, "With many upcoming launches and government land sales sites located close to an MRT station, we think there will be a lot of buying opportunities for prospective homebuyers. Although sentiment has been cautious owing to market uncertainties arising from the US trade tariffs and geopolitical conflicts, we believe a more benign interest rate environment, as well as the positive long-term outlook for Singapore real estate will help to support housing demand. In fact, with home loan rates falling from previous highs, about half of the respondents indicated that they are either motivated or very motivated to enter the market to buy a residential property."

Home loan rates have declined from over 4% p.a. in 2023 to around 2.3% to 2.6% p.a. presently. The 3-Month Compounded Singapore Overnight Rate Average (SORA) which banks use to price home loan packages has dropped steadily from the end of 2024, and stood at 1.97% p.a. as at 11 July 2025.

Turning to the rules on the harmonisation of gross floor area (GFA) definitions which came into effect from 1 June 2023, the survey showed that an overwhelming 84.4 per cent of the respondents are supportive of GFA harmonisation rules. In effect, the rules will include non-usable space (e.g. aircon ledge) in the GFA, and will reduce the total saleable area that developers can sell at the project. However, for the homebuyer, this means that they are paying for the space they can actually use. To this end, the GFA harmonisation rules help to maximise usability and efficiency of the layout, but they may also translate to a higher $PSF price as the price quantum is now calculated based on a reduced strata area.

You may download the full report here

About the PropNex Homebuyer Sentiment and Preferences Survey 2025

In a self-reported survey conducted between February and May 2025, PropNex polled more than 1,100 respondents - including participants at its various consumer education seminars and the Property Wealth System (PWS) masterclass sessions - on their housing preferences and views on the property market. Responses were also solicited via the firm's Telegram channel and its e-newsletter to subscribers. Duplicate responses have been removed from the dataset prior to data analysis. Around 58 per cent of the respondents are aged between 31 and 50 years old, 10 per cent of them are below 30 years old, while 32 per cent are aged 51 and above. Meanwhile, about 90 per cent of those polled are Singapore citizens, nearly 9 per cent are Singapore permanent residents, and just over 1 per cent are foreigners (non-PR).